- Abu Dhabi United Arab Emirates

Abu Dhabi Real Estate Market Report: Q2 2025

Executive Summary

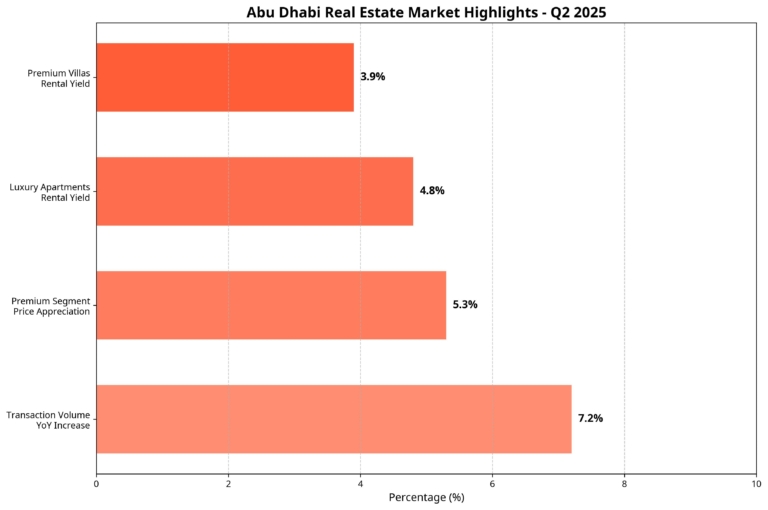

The Abu Dhabi real estate market demonstrated robust performance in Q2 2025, with a 7.2% year-on-year increase in transaction volume and a 5.3% appreciation in premium property values. Luxury waterfront properties in Saadiyat Island and Yas Island continue to lead the market, while emerging areas like Reem Hills show promising growth potential for investors.

7.2%

Year-on-year increase in transaction volume

5.3%

Average price appreciation in premium segments

4.8%

Average rental yield for luxury apartments

3.9%

Average rental yield for premium villas

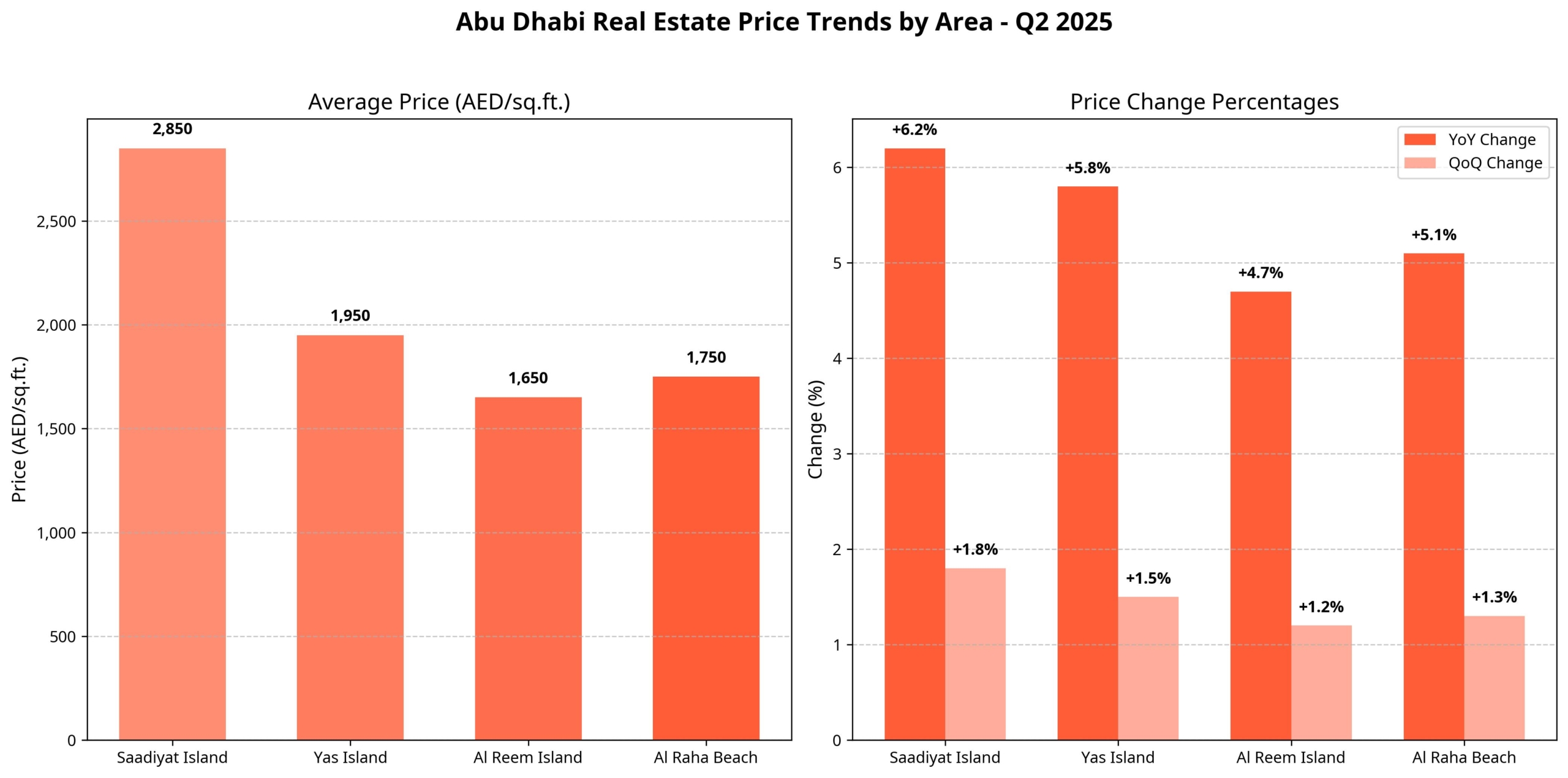

Price Trends by Area

Premium Areas Performance

| Area | Avg. Price (AED/sq.ft.) | QoQ Change | YoY Change |

|---|---|---|---|

| Saadiyat Island | 2,850 | +1.8% | +6.2% |

| Yas Island | 1,950 | +1.5% | +5.8% |

| Al Reem Island | 1,650 | +1.2% | +4.7% |

| Al Raha Beach | 1,750 | +1.3% | +5.1% |

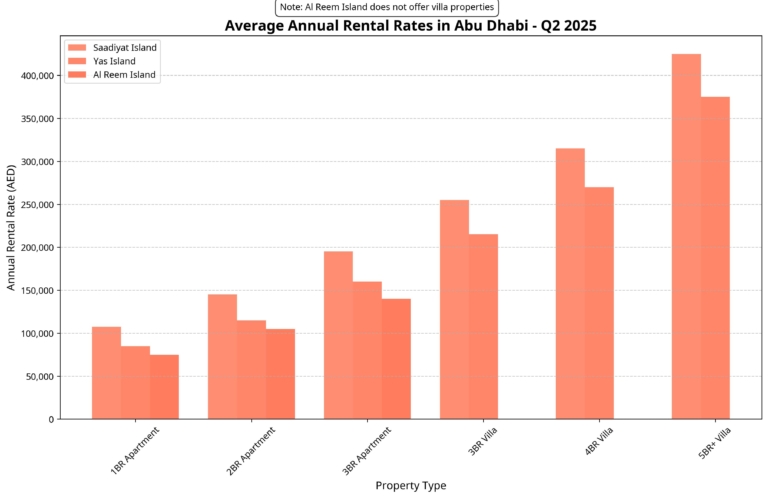

Rental Market Analysis

The Abu Dhabi rental market has stabilized in Q2 2025, with premium locations showing moderate growth of 3-4% annually. High-quality, well-maintained properties continue to command premium rents, while properties with unique features or prime locations can achieve rental premiums of 10-15% above market average.

Average Annual Rental Rates

| Property Type | Saadiyat Island | Yas Island | Al Reem Island |

|---|---|---|---|

| 1BR Apartment | AED 95,000–120,000 | AED 75,000–95,000 | AED 65,000–85,000 |

| 2BR Apartment | AED 130,000–160,000 | AED 100,000–130,000 | AED 90,000–120,000 |

| 3BR Apartment | AED 170,000–220,000 | AED 140,000–180,000 | AED 120,000–160,000 |

| 3BR Villa | AED 230,000–280,000 | AED 190,000–240,000 | N/A |

| 4BR Villa | AED 280,000–350,000 | AED 240,000–300,000 | N/A |

| 5BR+ Villa | AED 350,000–500,000+ | AED 300,000–450,000 | N/A |

Investment Insights

Top-Performing Investment Segments

- Waterfront Apartments in Saadiyat Island – Offering 5–6% yields and strong capital appreciation.

- Family Villas in Yas Island – 4–5% yields with steady demand.

- Studio/1BR in Al Reem Island – 6–7% yields with high rental demand.

Emerging Opportunity Areas

Reem Hills and Jubail Island offer 15–20% appreciation potential over the next 3–5 years due to development and infrastructure growth.

Market Outlook: Q3–Q4 2025

We anticipate continued market stability and moderate growth supported by:

- Government infrastructure investments

- Economic diversification

- Rising international interest

- Limited new supply in key areas

- Favorable financing

Premium locations may appreciate 4–6% annually; emerging zones even more as development completes.

Expert Insights

“Abu Dhabi’s luxury real estate market continues to demonstrate resilience and steady growth, particularly in premium waterfront locations. Investors seeking long-term value should focus on quality developments in established areas with unique selling points.” – Mohammed Al Hashimi, Head of Research, XIS Real Estate

Personalized Investment Consultation

For tailored advice on real estate investments aligned with your goals, contact our advisory team.