When it comes to buying property in the UAE, especially in real estate hotspots like Dubai and Abu Dhabi, investors and end-users often face a key decision: Should I buy ready property or invest in off-plan real estate? Each option offers distinct advantages and potential risks. This blog will break down the difference between ready and off-plan properties, their pros and cons, and help you make the right investment based on your goals.

What Is a Ready Property?

A ready property (also known as resale or secondary property) is a completed unit that is available for immediate handover. Buyers can view the actual property, assess the finishing quality, and move in or rent it out right after purchase.

What Is Off-Plan Property?

Off-plan properties in the UAE refer to units that are purchased before they are constructed or completed, often directly from developers like Emaar, Damac, Nakheel, or Sobha Realty. Buyers rely on floorplans, brochures, and developer promises, often waiting 2–4 years before handover.

Pros and Cons of Buying Ready Property in the UAE

✅ Pros of Ready Property:

-

Immediate Move-In or Rental Income

Perfect for end-users or investors looking for instant returns. -

What You See Is What You Get

View the actual unit, layout, community, and facilities. -

Established Neighborhoods

Most ready units are in mature areas with schools, malls, and infrastructure in place.

❌ Cons of Ready Property:

-

Higher Upfront Costs

Requires full payment or a mortgage (25% down payment for expats). -

Limited Capital Appreciation

Less price growth potential compared to off-plan during construction phases. -

Older Units

Maintenance and renovation costs may be higher if the property is not brand new.

Pros and Cons of Buying Off-Plan Property in the UAE

✅ Pros of Off-Plan Property:

-

Lower Prices & Payment Plans

Attractive post-handover payment plans and starting prices. -

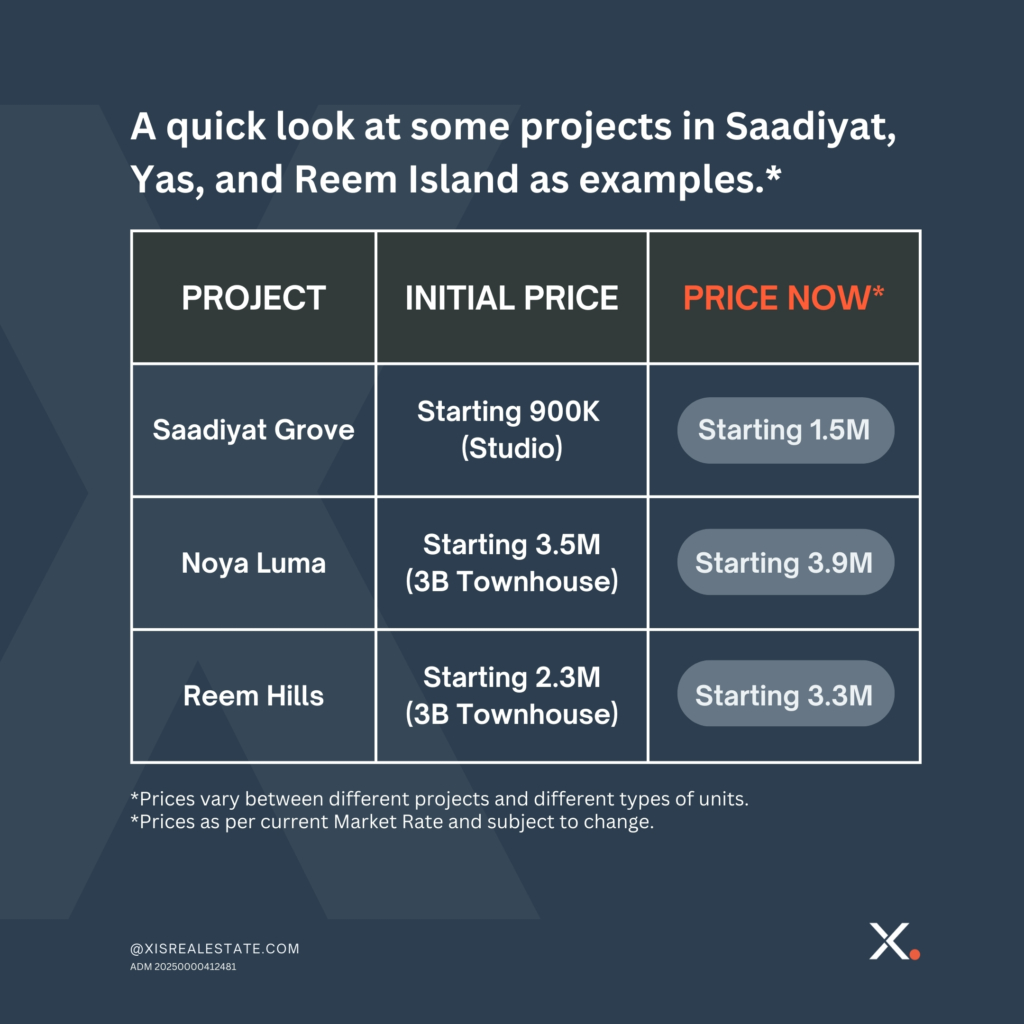

Higher Capital Appreciation Potential

Prices often rise during construction, allowing for strong ROI if timed well. -

Modern Designs & Smart Home Features

Newer builds come with high-end finishes, modern amenities, and better energy efficiency.

❌ Cons of Off-Plan Property:

-

Delayed Handover Risk

Construction delays or project cancellations can happen, although RERA regulations reduce this risk. -

No Immediate Rental Income

You’ll need to wait until the property is completed to generate returns. -

Developer Dependence

You rely on the developer’s reputation, track record, and delivery standards.

Which Is Better: Ready Property or Off-Plan Property in Dubai or Abu Dhabi?

The choice depends on your investment strategy and financial goals:

-

Choose ready property if:

-

You want to move in quickly.

-

You prefer a safe, tangible asset.

-

You need immediate rental income.

-

-

Choose off-plan property if:

-

You’re investing for the medium to long term.

-

You prefer lower initial payments.

-

You want to benefit from capital appreciation.

-

Final Thoughts: Ready vs Off-Plan Property Investment in the UAE

Both off-plan and ready properties in Dubai and Abu Dhabi offer excellent opportunities for residents and international investors. It’s crucial to work with a trusted real estate advisor who can match your needs with the right property, developer, and community.

At XIS Real Estate, we help you navigate the market, identify high-ROI areas, and choose between top off-plan launches or ready-to-move-in properties in premium communities like Downtown Dubai, Dubai Marina, Arabian Ranches, Yas Island, and Saadiyat Island.